Markets in transition

Aurubis at the epicenter of transformation

Global markets are undergoing profound and highly dynamic changes: Megatrends like electrification, the energy transition, and digitalization are driving demand for metals to unprecedented heights. As a leading multimetal producer, Aurubis is at the heart of this transformation.

Metals enable transformation

Accelerated expansion of renewable energy, advancing electrification and digitalization, and the associated infrastructure expansion will shape the economic agenda for the coming decade. Other growth areas include e-mobility, security and defense. What unites these trends is their role in causing a lasting surge in metal demand.

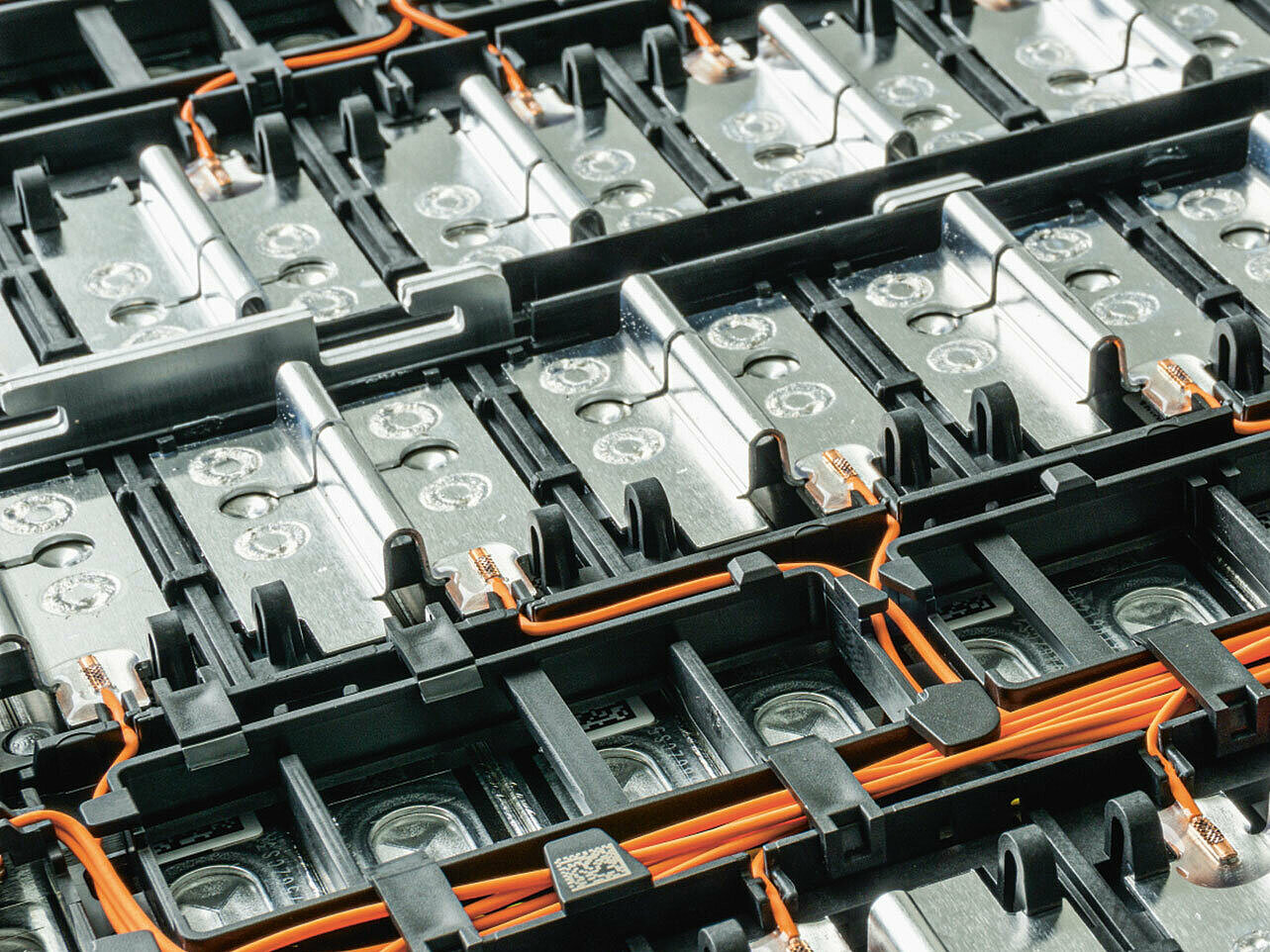

Metals like copper, nickel, silver and tin are crucial for advancements ranging from modern solar- and wind-powered energy production and e-mobility to data center expansion for digitalization and AI adoption. Consequently, these metals have become strategically critical raw materials for key global industries.

“The megatrends and demand they drive are real, and they will define the coming ten years.”

— Steffen Hoffmann, CFO

How megatrends drive demand

Just a few facts and figures make this strikingly clear: 200,000 new wind turbines will be built worldwide by 2035. Each one requires around 40 t of copper. The growing adoption of other renewable energy sources is also increasing demand: Globally around 10 million solar modules are expected to be built by 2035, boosting the need for silver and tellurium.

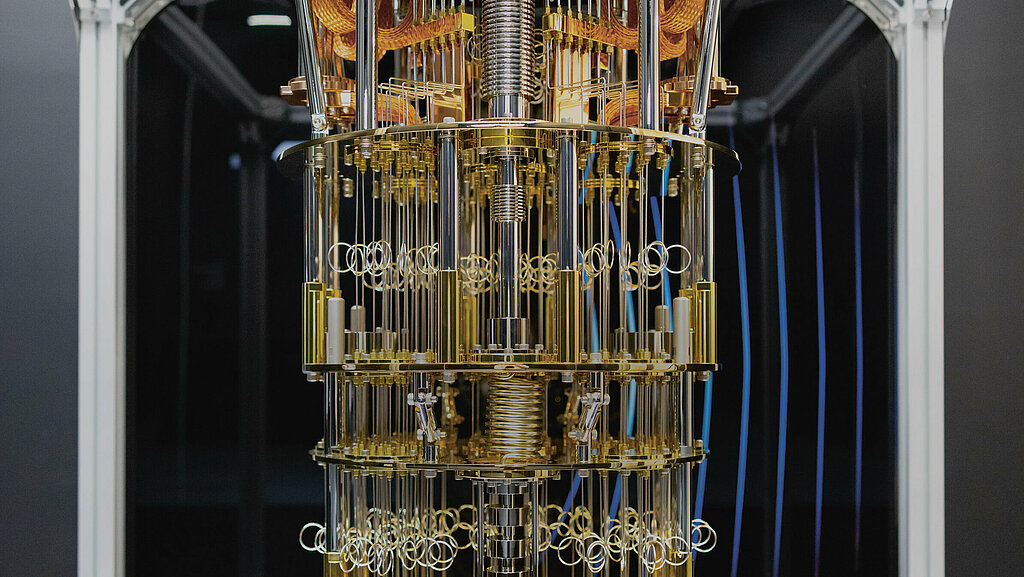

Forecasts predict that more than 1,000 new hyperscale data centers will be built in the same time period, each requiring up to 30,000 t of copper for power supply and cooling. Electrifying mobility is also heightening demand for metals like nickel and particularly copper, with 50 to 60 kg going into every electric vehicle. Although EV sales have recently stalled in Europe, the long-term global momentum behind electromobility remains strong. Studies project an additional 50 million electric vehicles by 2035.

The electrical and electronics market is also expected to double by 2035 — growth reflected in a significant jump in demand for the tin used in soldered connections. And finally, expanding infrastructure and defense activity are also driving metal demand: Copper is the second most critical material for the US defense industry, increased investment here will inevitably lead to a rising need for copper.

Global metal demand outlook

Market analyses are predicting copper demand will rise by 22 % over the next ten years. Demand is even expected to double by 2050. Around 26 % market growth is forecast for gold, 40 % for tin, and an impressive 82 % for tellurium.

Resilience for markets in transition

These global trends are fueling an exponential surge in multimetal demand. Experts are already calling this a “supercycle for metals.” Aurubis is at the epicenter of this transformation. In a world where metals are indispensable for technology, growth and resilience, we reliably deliver essential metals to key industries.

Dynamic and evolving markets come with challenges though too: As global supply chains grow increasingly fragile, the competition for limited resources is heating up. The pivotal role of metals in the greatest global transformations has elevated access to a question of geopolitical power — with supply security as the most valuable currency.

The concentrate or primary material market is currently tight, mainly due to growing demand for concentrates from China, where smelting capacity has been expanded, and from India, where rapid growth is fueling a rising appetite for raw materials. Global mine concentrate supply is expected to increase over the medium term, while the construction of new smelters slows, lowering demand so that the concentrate market is projected to gradually ease.

“Safeguarding access to recycling raw materials will be crucial.”

— Inge Hofkens, COO Multimetal Recycling

Intense competition and collection rates with room for improvement are limiting the availability of recycling materials as well. Global pressure to secure raw materials and rising metal prices are intensifying incentives for recycling. Safeguarding access to these recycling raw materials will be crucial.

Three questions for Anne Lauenroth

Deputy Head International Cooperation, Security, Raw Materials and Space department at the Federation of German Industries (BDI)

How are megatrends impacting global raw materials markets?

Megatrends are massively driving demand for copper, lithium and other metals. As a multimetal producer, Aurubis is in a good strategic position to benefit from this trend. A supercycle like this leads to price spikes and tighter competition for resources though too. And geopolitical uncertainties are also intensifying, fueled in part by trade conflicts, export restrictions, and political instability in producing countries. An era marked by uncertainty has become the “new normal.”

What should companies be prepared to face?

German industry’s raw material dependencies are much greater than they ever were on gas from Russia. China has built a monopoly position in processing through strategic policies, resulting in increasing supply risks, delivery bottlenecks, and rising costs for companies. So companies need to expand their risk and inventory management, diversify, hedge against price volatility, and look for more efficient or alternate material solutions. The German government will need to help hedge these risks, at least in part, and share costs — such as through raw materials funds.

How can we reduce international dependencies in Germany and Europe?

The EU and Germany have created the first instruments to reduce dependencies and build sovereignty in a new geopolitical environment with the Critical Raw Materials Act (CRMA) and the German Raw Materials Fund. Germany leads in metal recycling. The goal now is to further strengthen these advantages and secure energy-intensive production in Germany. Exploration and mining in Germany and the EU can make an important contribution to securing supply with high standards. It is crucial to involve the public and simplify and accelerate planning and approval processes. The EU will have to enter into more, and concrete, agreements to secure raw materials and strengthen European competitiveness.

Strengthening regional markets

As global supply chains approach their breaking point, supply security is emerging as a strategic factor. Aurubis is strengthening its footprint in the US with Aurubis Richmond, systematically scaling up local recycling capacities and significantly expanding the smelting capacity of its network. This is how we are contributing to stabilizing local supply chains and securing the supply of critical metals.

For more information on Aurubis Richmond, please see here.