Performance 2030

The new Aurubis strategy: Resilience aligned with peak performance

We’re setting a clear course to capitalize on the opportunities in a world in transformation with our revised strategy, ‘Aurubis Performance 2030. Forging resilience. Leading in multimetal.’ We’re building on our resilience and our strengths to safeguard our success — for the company, for our partners, and for society.

Aurubis Performance 2030 — The five pillars of our strategy

With ‘Aurubis Performance 2030. Forging resilience. Leading in Multimetal.’, we are actively shaping the future of our company and further expanding our leadership role. We are guided by sustainable growth, innovative power, and operative excellence — and creating value for our customers, partners, employees and shareholders. Together, we are steering Aurubis into a successful, resilient and sustainable future while securing our competitiveness in a dynamic market environment.

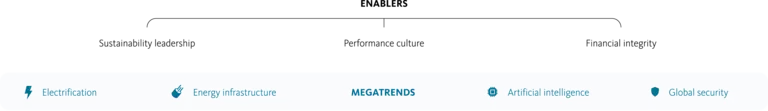

Our strategy is built on five pillars: Impact, Commercial Excellence, Efficiency, Innovation and Focused Growth. In combination with the performance culture, sustainability and financial strength enablers (read more), they form the foundation of our long-term success.

More information can be found in the video from the Capital Market Day 2025.

“We are committed to further strengthening our position as a leading copper and multimetal producer and setting industry standards for sustainable and efficient production.”

— Dr. Toralf Haag, CEO

The advanced strategy marks a shift in focus: After a phase of heavy investments, the emphasis is now on realizing returns and creating value. Aurubis will now fully leverage the synergies from completed investments, enhance competitiveness in growth markets, and drive targeted innovation. It’s not about growth at any cost — it’s about focused, value-creating growth in markets and segments where we already lead.

Three key enablers form the foundation for realizing our strategy:

Performance culture: We want to be successful: The vision for our company culture, Power for Performance, centers on achieving top performance and delivering the best possible results (read more). We pursue our strategy with clear priorities and strict capital discipline. Projects are carefully selected, and resources are deployed systematically to generate maximum value. “With our revised strategy, we have significantly sharpened our approach to achieve maximum impact,” COO Custom Smelting & Products Tim Kurth says.

Sustainability: Sustainability is not an afterthought at Aurubis — it is an integral part of our value creation. We build on transparent supply chains, certified standards, and products with substantially below-average CO₂ footprints. Our sustainability leadership fosters trust with customers and partners and secures long-term demand. “To us, sustainability isn’t just an obligation — it’s a competitive advantage,” COO Multimetal Recycling Inge Hofkens emphasizes.

Financial strength: A solid balance sheet, a high equity ratio, and a selective, value-oriented investment policy give Aurubis the financial stability to remain agile, even in volatile times. This enables us to deliver attractive returns for our investors and shareholders. “Our financial strength allows us to invest strategically and seize future opportunities,” CFO Steffen Hoffmann affirms.

“We forged the strategy together”

A strategy requires a solid foundation and broad endorsement in the company to develop its impact. This has worked out for Aurubis. Seonag Doherty, Vice President Corporate Development, explains our approach to strategy development in an interview.

Seonag, what was the starting point for the Aurubis strategy revision?

Seonag Doherty Our market environment is changing quickly: Political demands for more resource independence, global trade tensions, increasing regionalization, and limitations on raw material markets are structural challenges we face along the value chain. We adapted our strategy specifically to stay competitive and resilient under these conditions.

How did you tackle this process?

S. D. We started from a position of strength: Aurubis has a unique smelter network, excellent multimetal expertise, and a robust, strongly diversified business model. Building on this, we made the strategy process a company-wide endeavor: More than 70 colleagues from all sites, functions and levels were involved, leveraging the best expertise from across our business to build a sound strategy for the future. The Strategy function managed and coordinated the process, connecting the dots and consolidating the expert input and findings into a clear course of action.

How did you unite the various perspectives and ideas?

S. D. The Executive Board team helped define and deepen the focus areas of the strategy as well as setting guardrails and thresholds for project ideas to be taken forward. As an outcome we identified leverage in the Commercial division, flagship projects to further drive operational excellence, and additional paths to innovation. Our decisions were guided by our overarching goals of how to process increasingly complex input materials even better, optimize our network efficiency and flows, and deliver premium quality. The close collaboration among all parties involved — the Executive Board and the teams from Finance, R&D, Operations, Commercial, and Supply Chain Management to name a few — was crucial for combining so many components into an integrated plan. We impressively demonstrated what outstanding interdisciplinary and cross-site collaboration involves at Aurubis.

How does the company hope to enhance value creation?

S. D. We’re using our potential and focusing on creating value from our existing assets. We’re also investing in optimizing our facilities and processes — for instance through more efficient production cycles, improved material flows for intermediates, and process innovation and automation. All of this contributes to increasing our throughput, reducing costs, and ensuring the Aurubis quality and reliability our customers expect.

How will the success of Aurubis Performance 2030 be measured specifically?

S. D. In the coming years we want to reap the fruits of our current investment program totaling roughly €1.7 billion. We anticipate a positive annual contribution to earnings of €260 million (operating EBITDA) from our project landscape starting in the 2028/29 fiscal year. These projects include our new ASPA, BOB and CRH recycling facilities (read more) and our US site Aurubis Richmond. Following the start of Richmond commissioning in September 2025, we expect a significant return on investment in the medium term of €170 million. Our goal for the US is healthy growth based on our strengths.

Rising demand for copper and its mounting strategic importance in the US, combined with the country’s dependence on imports, are excellent opportunities for us when it comes to long-term business partnerships and potential follow-up investments. As pioneers in the recycling business, we want to make sure that valuable metals stay in North America.

What are you especially proud of?

S. D. The teamwork: We forged the strategy together. The colleagues involved worked passionately from the initial workshop to the final prioritization — with in-depth expertise and constructive dialogue, focused on the value contribution at all times. I’d like to thank the teams in Hamburg, Lünen, Beerse, Olen, Pirdop and Richmond and my colleagues from the different departments involved. I’m proud that we redefined our strategy using the best Aurubis minds, identified clear opportunities, and derived ways to make the results clearly measurable.

Our investment projects

We are consistently realizing our planned investment program

Since 2021, Aurubis has bolstered its core business through targeted investments in strategic projects in its smelter network, while simultaneously driving growth — particularly in the recycling segment. In addition to starting commissioning of the Aurubis Richmond US plant, we achieved further progress on our ongoing projects during the 2024/25 fiscal year. These strategic projects represent an investment of roughly €1.7 billion, with more than 75 % or €1.3 billion already invested by the end of fiscal year 2024/25. Investments designed to deliver value: Starting in fiscal year 2028/29, we expect these investments to generate an additional annual EBITDA contribution of approximately €260 million.

BOB — more metals for Europe

Bleed Treatment Olen Beerse is a state-of-the-art and energy-efficient recycling facility for treating electrolyte, known as bleed. Since commissioning in December 2024, Aurubis has used a hydrometallurgical process to recover valuable metals such as nickel and copper from the electrolyte streams generated in metal production at the Belgian sites Beerse and Olen. The project enables Aurubis to keep even more strategically relevant metals in the value cycle for Europe.

Aurubis Pirdop — doubling copper output

We will be doubling production capacities for copper by expanding the tankhouse, which will be commissioned in 2025/26, and we are continuing our decarbonization efforts with the ongoing extension of the solar park — a strong signal for our growth ambitions in Europe.

CRH — strengthening the internal cycle

With Complex Recycling Hamburg, we are unlocking the next level of performance in Hamburg. The facility will allow us to process around an additional 30,000 t of recycling material and internal complex smelter intermediates on a larger scale. A specially designed converter will efficiently process copper-lead matte into blister copper that will then be refined into copper cathodes in the plant. This enables considerably higher recovery and better energy utilization while easing the load on existing facilities. Commissioning is scheduled for fiscal year 2025/26.

Precious Metals Refinery — secure and efficient

We are setting benchmarks for safety and efficiency with the construction of an innovative precious metal processing facility in Hamburg: The entire processing chain with innovative operational and plant technology will be contained in one closed security area. Higher efficiency and reduced throughput times will significantly boost production capacity for precious metals while cutting operating costs at the same time. The new refinery is expected to go online in fiscal year 2026/27.